Forex Trading Mindset

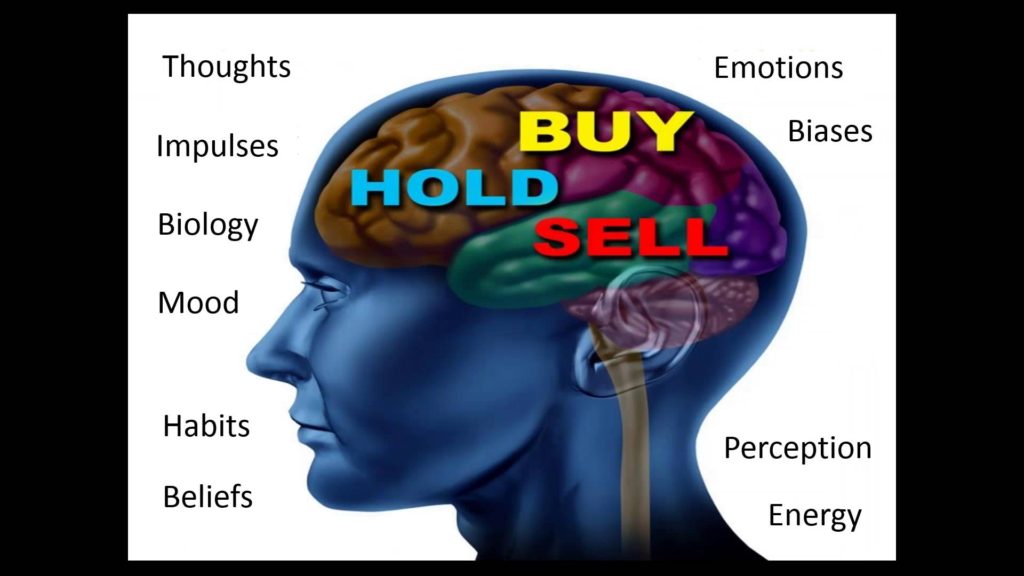

Brain of a Typical Forex Trader

What is the proper mindset to start Forex Trading?

The mindset of attitudes and beliefs held by an individual that will make us successful in trading.

A positive attitude is very important for every trader as if something is wrong you remain positive and try to fix it. Hunger of growth, a growth mindset will keep you on the path to continual improvement as long as you are growing as a person and as a trader you know that you will see financial improvement follow. It is so hard to share your faults especially those of yours that are leading other people. If you are willing to share struggles and reach out for help then it keeps you growing. Someone who has a winning trading mindset isn’t better than anyone else or smarter than anyone else. But understands that growing is challenging and you need to stay humble and keep learning or you will start to decline.

Self-examination is critical to developing a successful winning mindset. Becoming a profitable trader and maintaining a winning trading mindset is not going to be easy. Be ready for ups and downs and just keep moving forward and improving despite difficult times.

A lot of people seem to be unaware of the fact that they are trading with a mindset that is inhibiting them from making money in the markets. Instead, they think that if they just find the right indicator or system they will magically start printing money from their computer. Trading success is the end result of developing the proper trading habits, and habits are the end result of having the proper trading psychology. Accept the reality of how much money you have in your trading account and how much of that you are willing to lose per trade. Only trade with Disposable income, if you don’t have any disposable or risk capital, then keep demo trading until you do, or stop trading altogether, but whatever you do, do not trade with money you are going to become emotional about losing. Please try to understand that each and every trade is independent so you can’t assume that the next trade depends on your previous trade. The fact of the matter is that every time you trade it should just be seen as another execution of your trading edge; if you just had 3 consecutive winners you need to avoid risking more than usual on your next trade just because you are feeling very confident, and you need to avoid jumping back into the market right away after a losing trade just to try and “make back” what you lost.

I know you might think you don’t “need” to make one, but if you don’t plan and actually use it and tweak it as you learn, you will start trading on an unorganized and probably emotional path. Your trading plan could be that you write your own weekly commentary before each week begins, plan out what you will do and look for in the upcoming week…just make sure you have a “plan of attack” before you enter any trade.

Please try to keep an eye on Professional Trading Journals. Once you start keeping a journal of your trades it will become a habit, and you will not want to see emotional results staring back at you in your trade journal. Eventually, you will look at your trading journal as something of a work of art that proves your ability to trade with discipline as well as your ability to follow your trading plan.